Need An Accounting Professional?

We are an online cloud based accounting firm offering a full suite of accounting services to businesses and individuals across Canada. Our cloud based approach allows for simplicity and efficiency, and enables us to work effectively with a focus on you, the client!

With over 45 years of combined experience, a strong focus on our clients’ needs and careful attention to detail, we offer professional services with diligence and a knowledge-based approach to a variety of industries. Please see below for a listing of some of the services we offer; whatever your needs, we have a CPA to service your requirements.

We welcome you to reach out to us for your accounting, assurance or taxation needs. We are here to support you and help you achieve your goals; we are confident that you would find us friendly and valuable.

Contact Us today for a free 30 minute consultation.

Call Us 1-833-MMH-CPAS (664-2727) or E-mail info@mmh.cpa and join our growing list of satisfied clients!

Our Services Include:

Corporate Accounting and Analytics

- General Accounting

- Investment Accounting

- Self-employed Accounting

- Professional Services Accounting

- Rental Properties Accounting

- and much more…

Accounting Software and Bookkeeping Services

- Accounting system set-up, establishing procedures, maintaining books

- Configuration of QuickBooks online and integration with external platforms such as Shopify and BigCommerce

- Payroll services, including WSIB and EHT

- Sales tax filing

- Software training, including QuickBooks, Sage, and PCLaw

- and much more…

Taxation

- Personal and corporate tax filings

- Partnership returns (T5013)

- Taxation of deceased individuals and estates / trusts, including all applicable and optional returns

- Taxation of portfolio investments

- Non-resident tax filings

- Quebec tax filings – Personal and corporate

- Small business tax planning and scenario analysis

- Election regarding Change in Use of Residential Real Estate (Subsection 45(2) of Income Tax Act)

- Regulation 102 and 105 Waivers regarding Non-Resident Withholding Taxes

- Request by a Non-Resident of Canada for a Certificate of Compliance Related to the Disposition of Taxable Canadian Property

- Compliance and handling of audits and reviews by Canada Revenue Agency, including audits of Allowable Business Investment Losses (ABIL), employment expenses, rental losses, business expenses, replacement property rules, moving expenses, complex reviews of nursing home / medical expenses, and matters related to marital status

- US corporate and personal taxation with emphasis on cross-border issues. We offer this service through our network of tax specialists

- and much more…

Business Advisory

- Business Valuations

- Process Automation and Improvement

- Operational, compliance and value for money audits

- Risk Management

- Internal Controls testing and/or assessment

- Structuring of your corporation, including incorporation, dissolution, and amalgamation

- Support with financing applications

- Proforma and projection analysis

- Budgeting and forecasting

- Controllership services

- Customized financial analysis for various purposes

- General business advice and related analysis to aid with decision making and strategy

- and much more…

Assurance

- Financial Statement Audit

- Internal Audit

- Review

- Compliance Audit

- and much more…

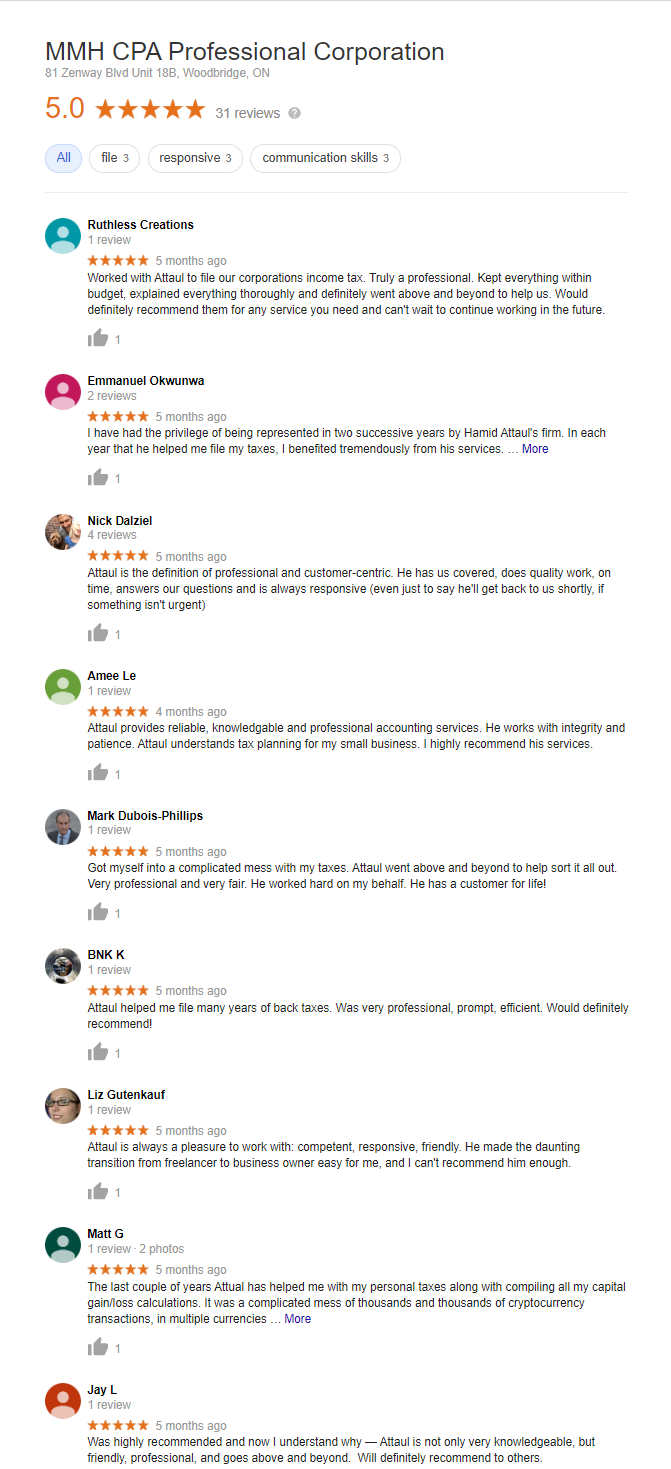

What Our Existing Clients Said About Us:

For more information Contact Us today.